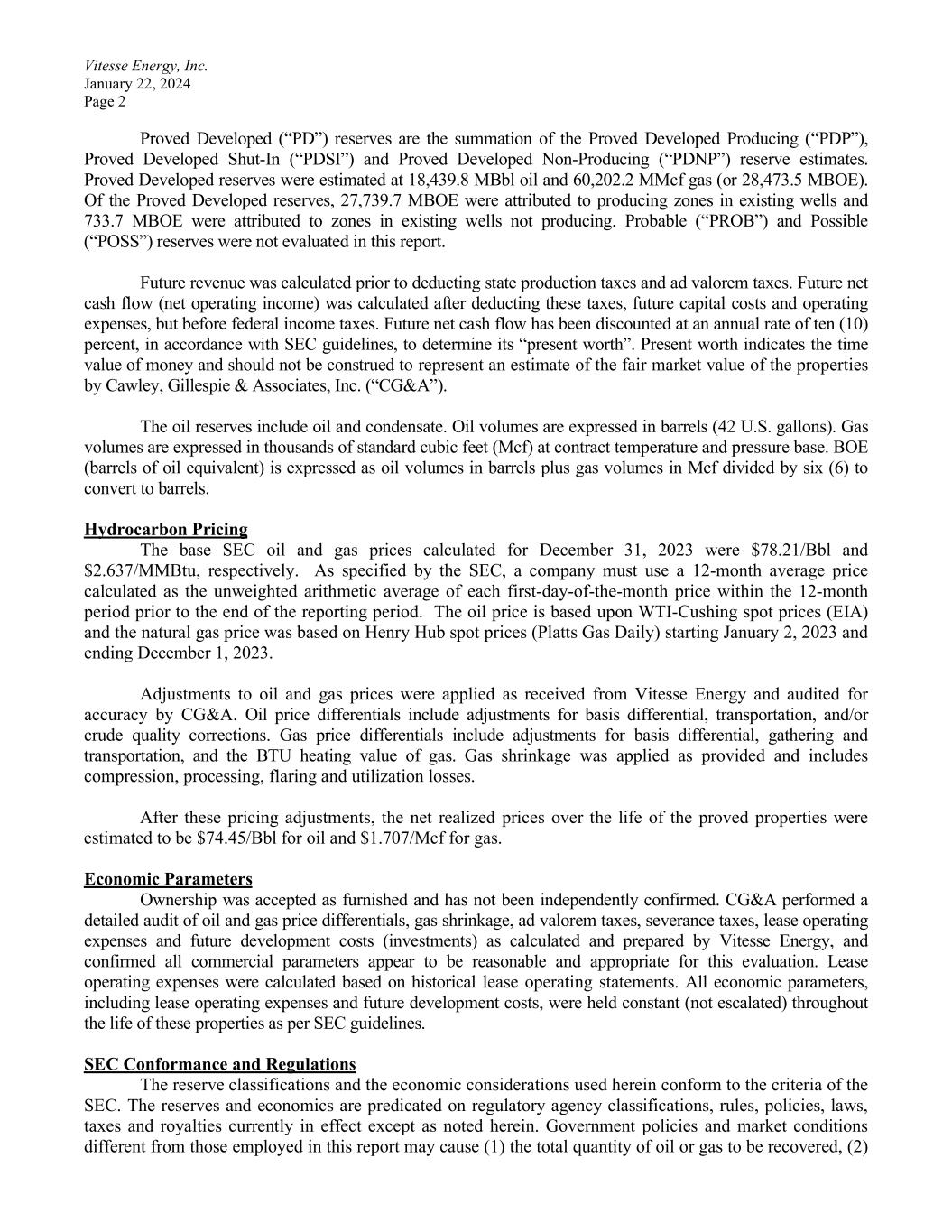

January 22, 2024 Ms. Patty Evans Vitesse Energy, Inc. 9200 E. Mineral Circle, Suite 200 Centennial, CO 80112 Re: Evaluation Summary – SEC Pricing Vitesse Energy, Inc. Certain Interests in Colorado, Montana, North Dakota and Wyoming Properties Total Proved Reserves As of December 31, 2023 Pursuant to the Guidelines of the Securities and Exchange Commission for Reporting Corporate Reserves and Future Net Revenue Dear Ms. Evans, As requested, this report was prepared on January 22, 2024 for Vitesse Energy, Inc. (“Vitesse Energy”) for the purpose of submitting our estimates of proved reserves and forecasts of economics attributable to the subject interests and for public disclosure by Vitesse Energy or its affiliates in filings made with the Securities and Exchange Commission (the “SEC”) in accordance with the disclosure requirements set forth in the SEC regulations. We evaluated 100% of Vitesse Energy’s Proved reserves, which are made up of Denver-Julesburg (“DJ”) Basin, Powder River (“PR”) Basin and Williston Basin oil and gas properties located in Colorado, Montana, North Dakota and Wyoming. This evaluation was prepared using constant prices and costs and conforms to Item 1202(a)(8) of Regulation S-K and other rules of the Securities and Exchange Commission (SEC). A composite summary of the values by reserve category is presented below: Proved Proved Proved Proved Total Developed Developed Developed Developed Proved Proved Net Reserves Producing Shut-In Non-Producing Summary Undeveloped Summary Oil - MBbl 17,942.6 37.9 459.3 18,439.8 9,303.3 27,743.1 Gas - MMcf 58,782.5 128.2 1,291.6 60,202.2 16,907.4 77,109.6 Oil Equivalent - MBOE 27,739.7 59.2 674.5 28,473.5 12,121.2 40,594.7 Future Revenue Oil - M$ 1,336,556.7 2,804.1 33,673.9 1,373,035.0 692,403.1 2,065,438.0 Gas - M$ 103,605.9 173.3 1,464.8 105,244.0 26,387.8 131,631.8 Severance Taxes - M$ 138,577.4 298.6 3,550.8 142,426.8 71,262.0 213,688.7 Ad Valorem Taxes - M$ 2,408.0 0.0 0.0 2,408.0 160.1 2,568.1 Operating Expenses - M$ 423,702.9 1,083.3 5,463.0 430,249.3 146,788.3 577,037.5 Future Development Costs - M$ 0.0 0.0 3,910.8 3,910.8 209,831.2 213,742.0 Abandonment Costs - M$ 15,242.3 63.0 95.6 15,400.9 2,543.2 17,944.1 Net Operating Income - M$ 860,231.6 1,532.4 22,118.5 883,882.6 288,206.5 1,172,089.2 Discounted at 10% - M$ 520,585.9 907.7 15,108.2 536,601.8 145,468.5 682,070.4

Vitesse Energy, Inc. January 22, 2024 Page 2 Proved Developed (“PD”) reserves are the summation of the Proved Developed Producing (“PDP”), Proved Developed Shut-In (“PDSI”) and Proved Developed Non-Producing (“PDNP”) reserve estimates. Proved Developed reserves were estimated at 18,439.8 MBbl oil and 60,202.2 MMcf gas (or 28,473.5 MBOE). Of the Proved Developed reserves, 27,739.7 MBOE were attributed to producing zones in existing wells and 733.7 MBOE were attributed to zones in existing wells not producing. Probable (“PROB”) and Possible (“POSS”) reserves were not evaluated in this report. Future revenue was calculated prior to deducting state production taxes and ad valorem taxes. Future net cash flow (net operating income) was calculated after deducting these taxes, future capital costs and operating expenses, but before federal income taxes. Future net cash flow has been discounted at an annual rate of ten (10) percent, in accordance with SEC guidelines, to determine its “present worth”. Present worth indicates the time value of money and should not be construed to represent an estimate of the fair market value of the properties by Cawley, Gillespie & Associates, Inc. (“CG&A”). The oil reserves include oil and condensate. Oil volumes are expressed in barrels (42 U.S. gallons). Gas volumes are expressed in thousands of standard cubic feet (Mcf) at contract temperature and pressure base. BOE (barrels of oil equivalent) is expressed as oil volumes in barrels plus gas volumes in Mcf divided by six (6) to convert to barrels. Hydrocarbon Pricing The base SEC oil and gas prices calculated for December 31, 2023 were $78.21/Bbl and $2.637/MMBtu, respectively. As specified by the SEC, a company must use a 12-month average price calculated as the unweighted arithmetic average of each first-day-of-the-month price within the 12-month period prior to the end of the reporting period. The oil price is based upon WTI-Cushing spot prices (EIA) and the natural gas price was based on Henry Hub spot prices (Platts Gas Daily) starting January 2, 2023 and ending December 1, 2023. Adjustments to oil and gas prices were applied as received from Vitesse Energy and audited for accuracy by CG&A. Oil price differentials include adjustments for basis differential, transportation, and/or crude quality corrections. Gas price differentials include adjustments for basis differential, gathering and transportation, and the BTU heating value of gas. Gas shrinkage was applied as provided and includes compression, processing, flaring and utilization losses. After these pricing adjustments, the net realized prices over the life of the proved properties were estimated to be $74.45/Bbl for oil and $1.707/Mcf for gas. Economic Parameters Ownership was accepted as furnished and has not been independently confirmed. CG&A performed a detailed audit of oil and gas price differentials, gas shrinkage, ad valorem taxes, severance taxes, lease operating expenses and future development costs (investments) as calculated and prepared by Vitesse Energy, and confirmed all commercial parameters appear to be reasonable and appropriate for this evaluation. Lease operating expenses were calculated based on historical lease operating statements. All economic parameters, including lease operating expenses and future development costs, were held constant (not escalated) throughout the life of these properties as per SEC guidelines. SEC Conformance and Regulations The reserve classifications and the economic considerations used herein conform to the criteria of the SEC. The reserves and economics are predicated on regulatory agency classifications, rules, policies, laws, taxes and royalties currently in effect except as noted herein. Government policies and market conditions different from those employed in this report may cause (1) the total quantity of oil or gas to be recovered, (2)

Vitesse Energy, Inc. January 22, 2024 Page 3 actual production rates, (3) prices received, or (4) operating and capital costs to vary from those presented in this report. However, we do not anticipate nor are we aware of any legislative changes or restrictive regulatory actions that may impact the recovery of reserves. This evaluation includes 786 commercial proved undeveloped locations. Each of these drilling locations proposed as part of Vitesse Energy’s development plans conforms to the proved undeveloped standards as set forth by the SEC. In our opinion, the operators of these drills have indicated they have reasonably certain intent to complete this development plan within the next five (5) years. Furthermore, Vitesse Energy and the other operators have demonstrated through their actions that they have the proper company staffing, financial backing and prior development success to ensure this development plan will be fully executed. Reserve Estimation Methods Reserves for proved developed producing wells were estimated using production performance methods for the vast majority of properties. Certain new producing properties with very little production history were forecast using a combination of production performance and analogy to similar production, both of which are considered to provide a relatively high degree of accuracy. All reserve estimates involve an assessment of the uncertainty relating to the likelihood that the actual remaining quantities recovered will be greater or less than the estimated quantities determined as of the date the estimate is made. The uncertainty depends mainly on the amount of the reliable geologic and engineering data available at the time of the estimate and the interpretation of such data, as well as the inherent uncertainties attributable to variations in reservoir and rock quality, offset drainage, mechanical wellbore integrity among others. The relative degree of uncertainty may be conveyed by placing reserves into one of two principal classifications, either proved or unproved. Unproved reserves are less certain to be recovered than proved reserves, and may be further sub-classified as probable and possible reserves to denote progressively increasing uncertainty in their recoverability. This report addresses only the proved reserves attributable to the properties evaluated herein. Non-producing reserve estimates, for both developed and undeveloped properties, were forecast using either volumetric or analogy methods, or a combination of both. These methods provide a relatively high degree of accuracy for predicting proved developed non-producing and undeveloped reserves for Vitesse Energy’s properties, due to the mature nature of their properties targeted for development and an abundance of subsurface control data. The assumptions, data, methods and procedures used herein are appropriate for the purpose served by this report. General Discussion The estimates and forecasts were based upon interpretations of data furnished by your office and available from our files. To some extent information from public records has been used to check and/or supplement these data. The basic engineering and geological data were subject to third party reservations and qualifications. Nothing has come to our attention, however, that would cause us to believe that we are not justified in relying on such data. All estimates represent our best judgment based on the data available at the time of preparation. Due to inherent uncertainties in future production rates, commodity prices and geologic conditions, it should be realized that the reserve estimates, the reserves actually recovered, the revenue derived therefrom and the actual cost incurred could be more or less than the estimated amounts. An on-site field inspection of the properties has not been performed. The mechanical operation or condition of the wells and their related facilities have not been examined nor have the wells been tested by Cawley, Gillespie & Associates, Inc. Possible environmental liability related to the properties has not been investigated nor considered.

Vitesse Energy, Inc. January 22, 2024 Page 4 Cawley, Gillespie & Associates, Inc. is a Texas Registered Engineering Firm (F-693), made up of independent registered professional engineers and geologists that have provided petroleum consulting services to the oil and gas industry for over 60 years. This evaluation was supervised by W. Todd Brooker, President at Cawley, Gillespie & Associates, Inc. and a State of Texas Licensed Professional Engineer (License #83462). We do not own an interest in the properties or Vitesse Energy, Inc. and are not employed on a contingent basis. We have used all methods and procedures that we consider necessary under the circumstances to prepare this report. Our work-papers and related data utilized in the preparation of these estimates are available in our office. Yours very truly, CAWLEY, GILLESPIE & ASSOCIATES, INC. TEXAS REGISTERED ENGINEERING FIRM F-693 W. Todd Brooker, P. E. President