December 2024 Lucero Energy Corp. Transaction Announcement

2 No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between Vitesse and Lucero, nor shall there be any offer or solicitation in any jurisdiction in which such offer or solicitation would be unlawful under the securities laws of any such jurisdiction. Notice Regarding Information Contained in This Presentation All amounts in this document are stated in U.S. dollars unless otherwise specified. This document contains references to "Boe" (barrels of oil equivalent) and "Mboe" (one thousand barrels of oil equivalent). The parties have adopted the standard of six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 Bbl) when converting natural gas to Boes. Boe and Mboe may be misleading, particularly if used in isolation. The foregoing conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading. All production volumes presented in this document are reported on a "net" basis (a company's working interest share after deduction of royalty obligations, plus the company's royalty interests), which differs from "gross" basis (a company’s working interest before deduction of royalties) for reporting production under National Instrument 51-101 and industry practice in Canada. All references to "oil" in this presentation include light and tight crude oil. Additional Information and Where You Can Find It In connection with the proposed transaction, Vitesse and Lucero intend to file materials with the Securities and Exchange Commission (the “SEC”) and on SEDAR+, as applicable. Vitesse intends to file a Proxy Statement with the SEC in connection with the solicitation of proxies to obtain Vitesse stockholder approval for the issuance of stock in the proposed transaction, and Lucero intends to file an information circular and proxy statement (the "“Circular"”) with the TSX Venture Exchange (“TSXV”) and on SEDAR+ in connection with the solicitation of proxies to obtain Lucero shareholder approval of the proposed transaction. Vitesse intends to mail or otherwise provide a Proxy Statement to the stockholders of Vitesse. This presentation is not a substitute for the Proxy Statement, the Circular or for any other document that Vitesse or Lucero may file with the SEC or on SEDAR+ and/or send to Vitesse’s stockholders and/or Lucero’s shareholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF VITESSE AND LUCERO ARE URGED TO CAREFULLY AND THOROUGHLY READ THE PROXY STATEMENT AND THE CIRCULAR, RESPECTIVELY, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY VITESSE AND/OR LUCERO WITH THE SEC OR ON SEDAR+, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VITESSE, LUCERO, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. Shareholders of Vitesse and Lucero will be able to obtain free copies of the Proxy Statement and the Circular, as each may be amended from time to time, and other relevant documents filed by Vitesse and/or Lucero with the SEC or on SEDAR+ when they become available through the website maintained by the SEC at www.sec.gov or on SEDAR+ at www.sedarplus.ca, as applicable. Copies of documents filed with the SEC by Vitesse will be available free of charge from Vitesse’s website at ir.vitesse-vts.com or by contacting Vitesse’s Investor Relations Department at (720) 532-8232. Copies of documents filed on SEDAR+ by Lucero will be available free of charge from Lucero’s website at www.lucerocorp.com/investors/ or by contacting Lucero’s Investor Relations Department at (877) 573-0181. Participants in the Solicitation Vitesse and its directors, executive officers and certain other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from Vitesse’s stockholders in connection with the proposed transaction. Information regarding the interests of the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of Vitesse in connection with the proposed transaction, will be set forth in the Proxy Statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Vitesse and its directors and executive officers and their ownership of Vitesse common stock in the Proxy Statement for Vitesse’s 2024 Annual Meeting, filed with the SEC on March 20, 2024, and additional information about the ownership of Vitesse common stock by Vitesse directors and executive officers is included in their Forms 3, 4 and 5 filed with the SEC. Important Disclosures

3 Certain statements in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include statements concerning the proposed transaction, including any statements regarding the expected timetable for completing the transaction, the results, effects, benefits and synergies of the transaction, future opportunities for Vitesse future financial performance and condition, guidance and any other statements regarding Vitesse’s or Lucero’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecast,” “predict,” “outlook,” “target,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “likely” “plan,” “positioned,” “strategy,” and similar words and expressions. Specific forward-looking statements include statements regarding Vitesse's or Lucero's plans and expectations with respect to the transaction, the timing of closing, the anticipated cash to be acquired as part of the transaction and its use to repay borrowings under Vitesse’s revolving credit facility, the anticipated impact of the transaction on Vitesse’s results of operations, financial position, growth opportunities, operational flexibility and competitive position, Vitesse’s hedging strategy, returns to stockholders and enhanced stockholder value and the anticipated increase to Vitesse’s dividend following the closing of the transaction, expense synergies resulting from the transaction, and the composition of the board of directors of Vitesse following the closing. Forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that stockholders of Vitesse may not approve the issuance of new shares of Vitesse common stock in the transaction or that shareholders of Lucero may not approve the transaction; the risk that a condition to closing of the transaction may not be satisfied; that either party may terminate the arrangement agreement or that the closing of the transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships of Vitesse or Lucero, including those resulting from the announcement or completion of the transaction; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Vitesse and Lucero; the effects of the transaction, including Vitesse’s future financial condition, results of operations, strategy and plans; the ability of Vitesse to realize anticipated synergies in the timeframe expected or at all; changes in capital markets; regulatory approval of the transaction; the effects of commodity prices, including any resulting impact on Vitesse’s ability to sustain its anticipated dividend following the closing of the transaction; the risks of oil and gas activities; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, strategies for the company's operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters. Additional factors that could cause actual results to differ materially from those anticipated can be found in Vitesse's Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q, which are on file with the SEC and available from Vitesse's website at ir.vitesse-vts.com, and in other documents Vitesse files with the SEC; and in Lucero's annual information form for the year ended December 31, 2023, which is on file with TSXV and on SEDAR+ and available from Lucero’s website at www.lucerocorp.com/investors/, and in other documents Lucero files with TSXV or on SEDAR+. All forward-looking statements speak only as of the date they are made and are based on information and assumptions believed to be valid at that time. Neither Vitesse nor Lucero assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by applicable securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Non-GAAP Financial Measure Projected Adjusted EBITDA, net debt, and free cash flow are specified financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP measure should not be considered in isolation or as a substitute for net income (loss), operating income (loss), net cash provided by (used in) operating activities, earnings (loss) per share or any other measures prepared under GAAP. Because these non-GAAP measures exclude some but not all items that affect net income (loss) and may vary among companies, the amounts presented may not be comparable to similar metrics of other companies. Vitesse is not able to reconcile forward-looking non-GAAP financial measures and ratios included in this presentation because it is unable to predict without unreasonable effort the exact amount or timing of the reconciling items. The variability of these items could have a significant impact on future GAAP financial results. Cautionary Statement Regarding Oil and Gas Quantities The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves, which are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible— from a given date forward, from known reservoirs, and under existing economic conditions (using unweighted average 12-month first day of the month prices), operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities of the exploration and development companies may justify revisions of estimates that were made previously. If significant, such revisions could impact Vitesse’s and Lucero's strategy and future prospects. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered. The SEC also permits the disclosure of separate estimates of probable or possible reserves that meet SEC definitions for such reserves; however, neither Vitesse nor Lucero currently discloses probable or possible reserves in its SEC filings. The production forecasts and expectations of the combined company for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. Cautionary Statement Regarding Forward-Looking Statements

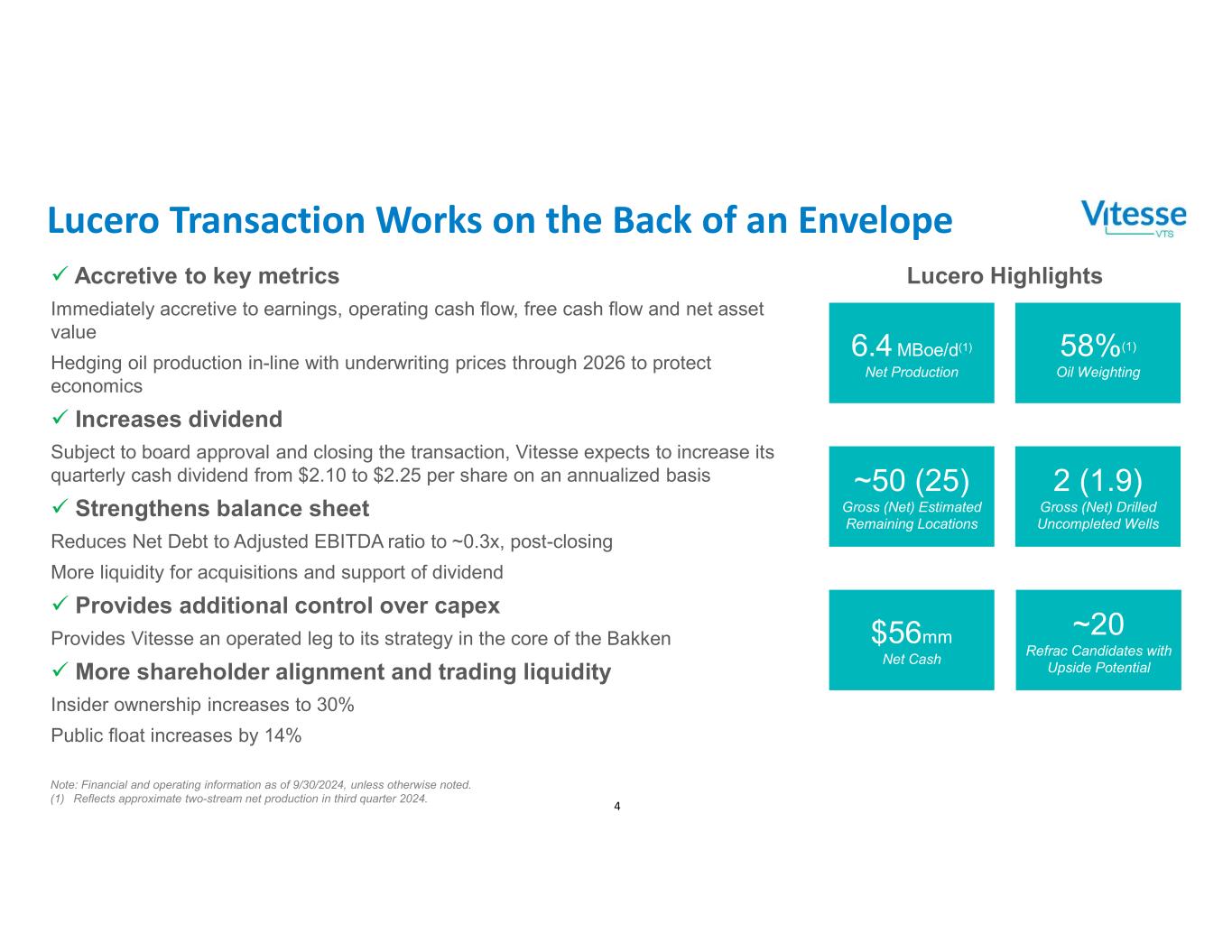

4 Lucero Transaction Works on the Back of an Envelope Accretive to key metrics Immediately accretive to earnings, operating cash flow, free cash flow and net asset value Hedging oil production in-line with underwriting prices through 2026 to protect economics Increases dividend Subject to board approval and closing the transaction, Vitesse expects to increase its quarterly cash dividend from $2.10 to $2.25 per share on an annualized basis Strengthens balance sheet Reduces Net Debt to Adjusted EBITDA ratio to ~0.3x, post-closing More liquidity for acquisitions and support of dividend Provides additional control over capex Provides Vitesse an operated leg to its strategy in the core of the Bakken More shareholder alignment and trading liquidity Insider ownership increases to 30% Public float increases by 14% Note: Financial and operating information as of 9/30/2024, unless otherwise noted. (1) Reflects approximate two-stream net production in third quarter 2024. $56mm Net Cash 6.4 MBoe/d(1) Net Production 58%(1) Oil Weighting 2 (1.9) Gross (Net) Drilled Uncompleted Wells ~20 Refrac Candidates with Upside Potential ~50 (25) Gross (Net) Estimated Remaining Locations Lucero Highlights

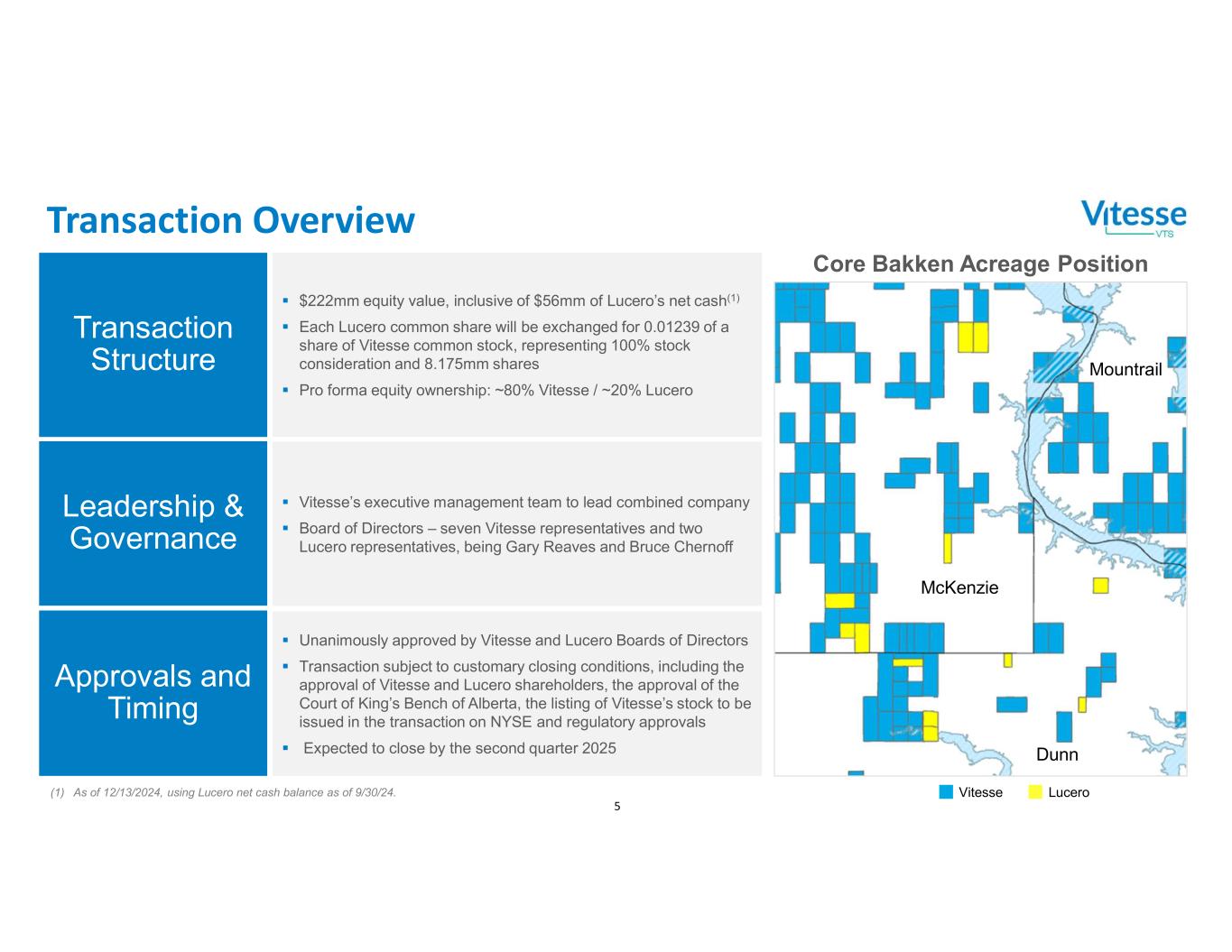

5 Transaction Overview Transaction Structure (1) As of 12/13/2024, using Lucero net cash balance as of 9/30/24. $222mm equity value, inclusive of $56mm of Lucero’s net cash(1) Each Lucero common share will be exchanged for 0.01239 of a share of Vitesse common stock, representing 100% stock consideration and 8.175mm shares Pro forma equity ownership: ~80% Vitesse / ~20% Lucero Leadership & Governance Approvals and Timing Vitesse’s executive management team to lead combined company Board of Directors – seven Vitesse representatives and two Lucero representatives, being Gary Reaves and Bruce Chernoff Unanimously approved by Vitesse and Lucero Boards of Directors Transaction subject to customary closing conditions, including the approval of Vitesse and Lucero shareholders, the approval of the Court of King’s Bench of Alberta, the listing of Vitesse’s stock to be issued in the transaction on NYSE and regulatory approvals Expected to close by the second quarter 2025 McKenzie Dunn Mountrail Vitesse Lucero Core Bakken Acreage Position